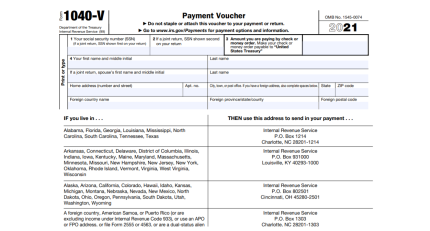

1040-B Form Online

- 30 November 2022

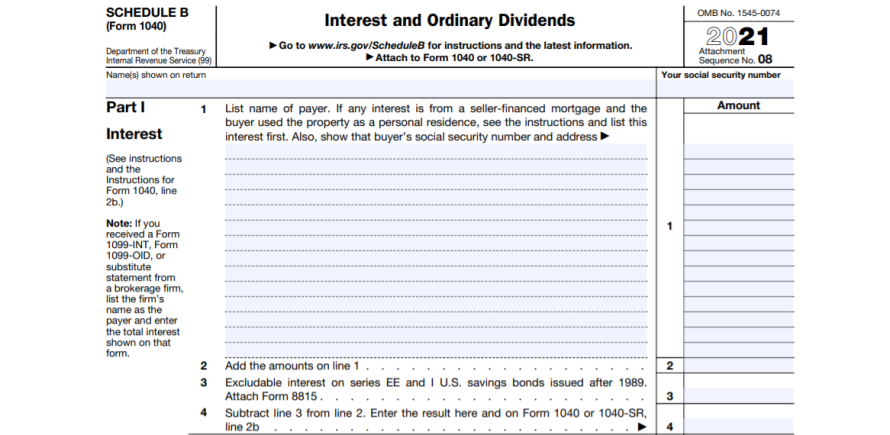

Form 1040-B is used to report the income and deductions of a U.S. citizen or resident alien who is the beneficiary of a foreign estate or trust. The form is used to report the beneficiary's share of the income, deductions, and credits from the estate or trust.

- What is a Form 1040-B?

A Form 1040-B is an Internal Revenue Service (IRS) form used by individuals who receive certain types of income from foreign sources. The form is also used to report certain foreign-related transactions. - What is the due date for filing a 1040-B Form?

The due date for filing is June 15th. However, if you file your return electronically, the due date is extended to the 17th. - What is the penalty for not filing Form 1040-B?

There is a not filing 1040-B. The penalty is $100 for each month or part of a month that the form is late, up to a maximum of $500.