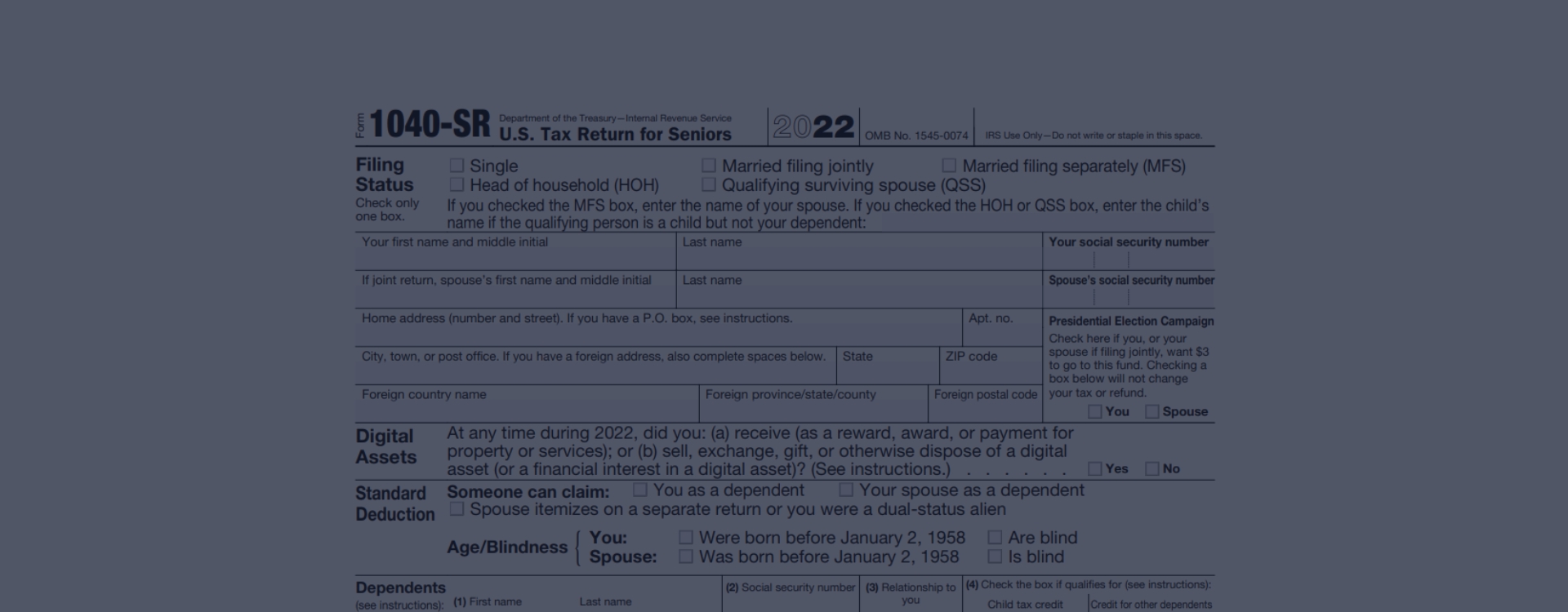

1040-SR Form: Tax Return for Seniors

The 1040-SR Form is a series document used for tax returns. Different categories of taxpayers use different templates of this series. The IRS 1040-SR tax form was specially designed for citizens over 65 years of age in 2018. It is similar to the original file and has the same instructions but is optimized specifically for the elderly. It requires almost the same information as for documnet. Additional attention is paid to various senior-specific benefits. Also, for the convenience of adult taxpayers, the text on this document was made in a larger font. Form 1040-SR is an optional variant designed to simplify tax filing for retirees. You can use the original template if you like.

Who Can File IRS Form 1040SR 2021

- Taxpayers who will be 65 years of age or older by the end of the tax year. This template was designed specifically for senior citizens. Young people should not use it.

- Working seniors who have income. You do not have to be retired to fill out the Form 1040-SR PDF; you can continue to work. By the way, there are no restrictions on the total amount of income.

Why Do You Need 1040-SR Form?

The printable 1040-SR Form is used to enable taxpayers over 65 to declare their sources of income and calculate and pay taxes due. If you have investments, social security, retirement plans, or other sources of revenue, you should indicate them on the 1040-SR tax form. Also, this document allows the state to understand whether a citizen needs to receive a tax refund. With it, you can implement an itemized or a standard deduction. The tax return is a required document for all citizens of the country who have income. If you are 65 or older, you can use a printable tax form 1040-SR instead.

1040SR Deadlines

According to 1040-SR instructions, every eligible taxpayer must submit this paper annually by April 15th. As with other types of tax returns, you can request an extension if necessary and extend the deadline by two months. At the same time, the deadline for payment of due taxes remains unchanged.

Try Now!

How to Complete IRS Form 1040-SR 2021?

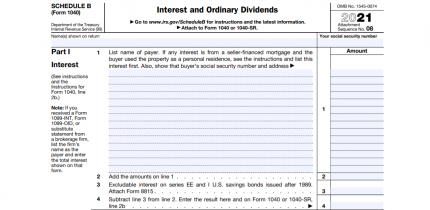

The 1040-SR instruction 2021 is no different from the previous year as the IRS has not revised it. The document consists of four pages and can be conditionally divided into two parts: personal information and income data. First, you need to fill out the first block and put your spouse or dependents' information, if any. Part two of the 1040-SR US tax return seniors focuses on calculating taxes based on your income data. Depending on your source of funds, you may need additional documents, such as 4972, 1099, or 8995. Keep them nearby to write out the information you need. Read the tips in the document carefully and check out the IRS 1040-SR instructions to fill in all the lines correctly.

IRS Filing Recommendations

-

![Two Options for Filing]() Two Options for FilingAlthough the IRS provides two options for filing a documents, paper and electronic, it encourages taxpayers to choose the second one, as it allows them to process your files in half the time.

Two Options for FilingAlthough the IRS provides two options for filing a documents, paper and electronic, it encourages taxpayers to choose the second one, as it allows them to process your files in half the time. -

![Filing Electronically]() Filing ElectronicallyThe IRS currently lets all taxpayers submit documents electronically. You can complete and file the IRS Form 1040-SR PDF on your own or using tax software.

Filing ElectronicallyThe IRS currently lets all taxpayers submit documents electronically. You can complete and file the IRS Form 1040-SR PDF on your own or using tax software. -

![Paper Filing]() Paper FilingYou can use the 2021 1040-SR printable tax form and, once printed, mail the paper to a tax office in your state. Look for a list of addresses on the IRS website.

Paper FilingYou can use the 2021 1040-SR printable tax form and, once printed, mail the paper to a tax office in your state. Look for a list of addresses on the IRS website.

Most Asked Questions About 1040-SR

- Where can I get the 2021 Form 1040-SR printable?You can find an empty template on the official resource of the tax service for free. You can also fill out or download this form on our website.

- Who can't use 1040SR Form?If you are under 65, you cannot file this tax return. You should reach this age by the end of the year. Otherwise, you can't use the 1040-SR. Even if you are an early retiree, you still need to fill out other documents.

- How soon will my return be processed?It depends on how you submit your documents. If you pick the electronic option, it will take about three weeks. If you file physical papers, then the deadline can be much more extended (6 to 8 weeks)

Popular Form 1040-SR Versions & Alternatives

1040-B Form Online Form 1040-B is used to report the income and deductions of a U.S. citizen or resident alien who is the beneficiary of a foreign estate or trust. The form is used to report the beneficiary's share of the income, deductions, and credits from the estate or trust. What is a Form 1040-B?A Form 1040-B...

1040-B Form Online Form 1040-B is used to report the income and deductions of a U.S. citizen or resident alien who is the beneficiary of a foreign estate or trust. The form is used to report the beneficiary's share of the income, deductions, and credits from the estate or trust. What is a Form 1040-B?A Form 1040-B... - 30 November, 2022

- 1040-V Form Printable Form 1040-V is used to indicate to the IRS that a payment has been made. The form is used to indicate the amount of the payment, the type of payment, and the taxpayer's identifying information. The form is also used to indicate whether the payment was made in full or in part. What is Form 1040-V?...

- 28 November, 2022

- 1040-D Form Online Form 1040-D is used to report the sale or exchange of a capital asset, such as stocks, bonds, or real estate. The form must be filed within 30 days of the sale or exchange. The form reports the date of the sale or exchange, the amount of the gain or loss, and the basis of the asset. What is Form...

- 24 November, 2022

Please Note

This website (1040sr-form-irs.com) is not an official IRS website. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.