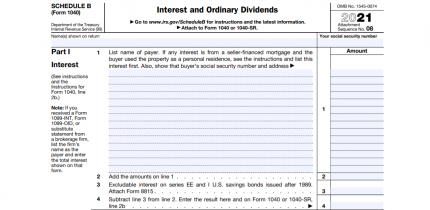

1040-V Form Printable

- 28 November 2022

Form 1040-V is used to indicate to the IRS that a payment has been made. The form is used to indicate the amount of the payment, the type of payment, and the taxpayer's identifying information. The form is also used to indicate whether the payment was made in full or in part.

- What is Form 1040-V?

Form 1040-V is a form used to indicate the amount of tax paid on a payment made to the IRS. - When is Form 1040-V due?

Form 1040-V is due within 30 days of the payment. - What is the penalty for not filing 1040-V?

The penalty for not filing 1040-V Form is $50 per payment.