1040-D Form Online

- 24 November 2022

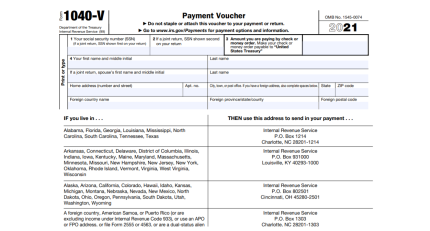

Form 1040-D is used to report the sale or exchange of a capital asset, such as stocks, bonds, or real estate. The form must be filed within 30 days of the sale or exchange. The form reports the date of the sale or exchange, the amount of the gain or loss, and the basis of the asset.

- What is Form 1040-D?

Form 1040-D is an IRS form used to report distributions from qualified retirement plans, including individual retirement accounts (IRAs). - What are the requirements for filing Form 1040-D?

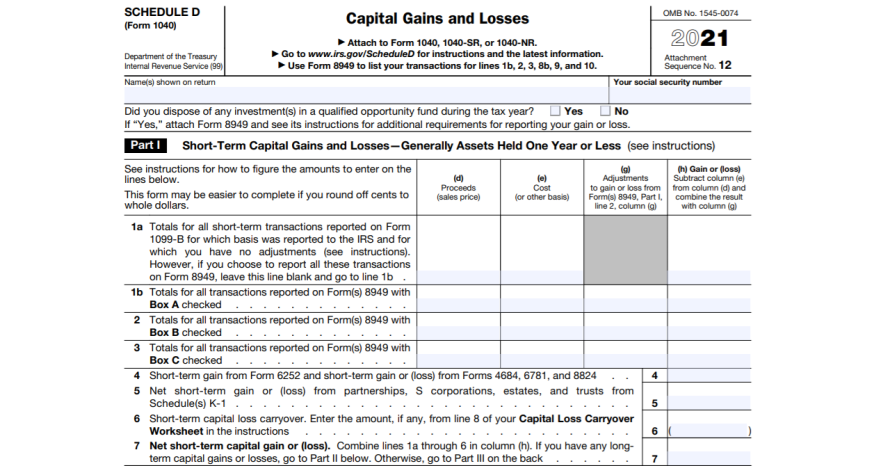

To file Form 1040-D, you must be receiving distributions from a qualified retirement plan, such as a 401(k) or IRA. - What is the deadline for filing Form 1040-D?

The deadline for filing Form 1040-D is April 15th.